Sturgeon believes that investments in Central Asia can generate exaggerated social impact per dollar invested due to the current low development base and the lack of available capital. Incorporating impact measurement and management throughout our investment process increases the resiliency of our investee companies, and in doing so ensures the sustainability of the impact generated and the strength of returns to our investors. Impact is a core part of our investment analysis, from the sourcing of deals to exit, and it plays a key role in risk management.

An introduction to Sturgeon’s impact investing approach

Jun 18, 2020

“Above all, job creation will be the key factor for developing countries to reduce poverty, improve people’s lives, and reach the Sustainable Development Goals by 2030… Creating more and better jobs requires economic transformation:…it is essential to harness the technological innovation and entrepreneurship that the digital age has unleashed”

Axel van Trotsenburg, Vice-President of Development Finance, World Bank (2018)

The central premise of our impact framework is that investing in innovative, technology-enabled companies that create private-sector jobs can generate long-term sustainable social impact and superior financial returns for investors. This framework delivers meaningful social impact by empowering private entrepreneurs to grow their businesses, in turn creating employment opportunities which we believe are the most effective driver of social change in developing markets.

Across our portfolio, Sturgeon encourages technology adoption and innovation, bringing in international expertise to train local employees and insisting upon the highest corporate governance standards. The efficient and profitable companies our approach fosters are also more resilient during periods of economic volatility.

Establishing Sturgeon’s Fund targets

Sturgeon Uzbekistan Growth Fund (SUGEF) has dual-targets:

- Ensure every portfolio company realises a 40% internal rate of return (IRR) (1)

- Support 500,000 jobs through our investee companies(2) by encouraging technological innovation for SMEs and the mass market.

Empowering people through employment can deliver long-term, sustainable and productive social impact. This is even more the case for the region’s youth, on whom the future success of their economies depends. Please see the appendix for a breakdown of regional unemployment data.

We enable change by providing companies with capital and technical expertise to empower entrepreneurs to grow their business and in doing so increase individual and societal wealth. There is a real necessity for product and service innovation to meet the needs of 87 million consumers in the region.

We have developed a system of quantitative and qualitative KPIs to track the performance of our portfolio against both impact and financial return objectives: these metrics are complementary and inseparable. KPIs are grouped into three categories: impact; risk management, which includes environmental, social and governance (ESG) risks; and financial. Our KPIs across all three categories drive businesses around outputs and outcomes that are critical to achieving our financial and social return objectives. In this article, we summarise our approach to tracking impact KPIs which are directly measurable and aligned with the company’s financial bottom line.

Sourcing and screening

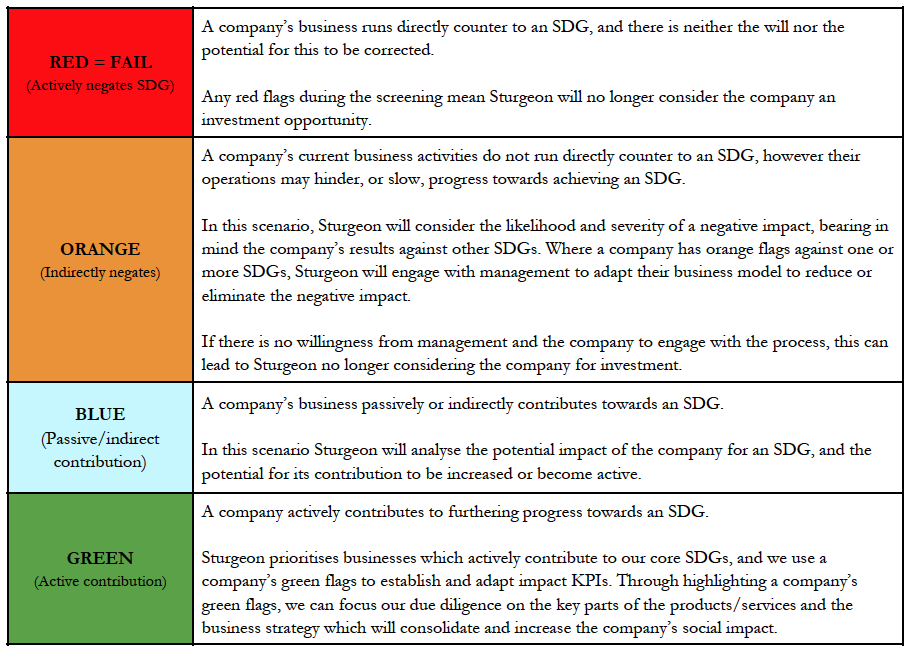

As part of our initial due diligence process, every investment is screened through the lens of our UN Sustainable Development Goals (SDGs) traffic light system. When a company passes our initial due diligence and impact screens, we undertake a more comprehensive due diligence assessment.

Sturgeon uses the SDGs as the basis for our impact objectives, specifically Goal 8.2 to “achieve higher levels of economic productivity through diversification, technological upgrading and innovation” and Goal 8.5 to “achieve full and productive employment and decent work for all,”. We believe our companies are well-positioned to support SDG 8 Decent Work and Economic Growth, which according to research by SDSN and Bertelsmann Stiftung(3) is among the most difficult for developing countries to achieve. Many of our companies also actively contribute to other SDGs, particularly SDG 8 No Poverty.

|

To promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all. |

We summarise Sturgeon’s SDG traffic light screening approach below:

Investment Management

To reduce information asymmetry and monitor potential investment targets, we go beyond the financial reports and management projections. Following our initial rounds of questioning, we establish all the key variables that drive a given business and map them on to trackable data points. We then work with individual companies to develop an infrastructure which allows us to monitor verifiable data points in real-time. This system provides us with reliable data to monitor the business and guide our discussions with management. This data infrastructure is kept in place throughout our investment holding period and is a key component for informing our strategy.

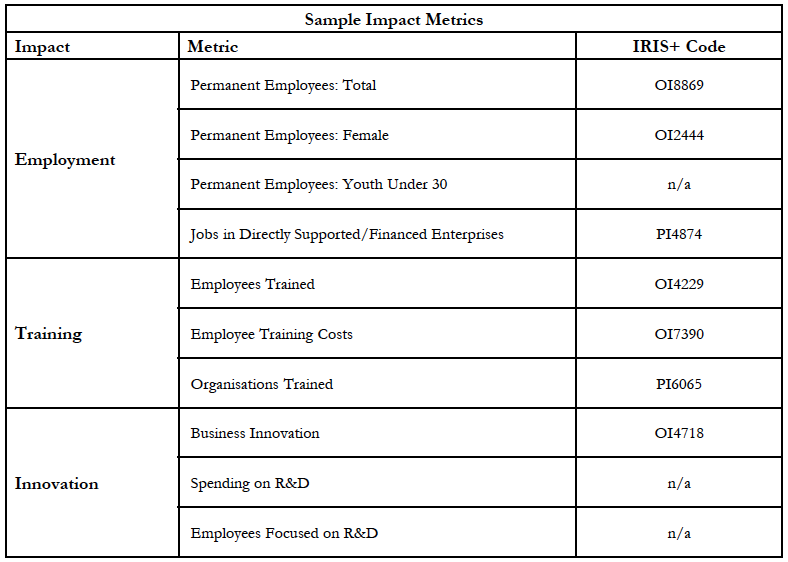

Sturgeon uses the GIIN’s IRIS+(4) system to measure, manage and optimise impact across its investments. As one of the most widely used systems for impact measurement and management, we rely on IRIS+ as the basis for developing our portfolio and investment specific KPIs. Choosing KPIs is a detailed process for each investment, and where necessary we adapt IRIS+ metrics to be relevant or develop our own.

The IRIS+ metrics, once adapted for each investment, form the basis of the reporting framework we implement with our investee companies. This framework tracks the KPIs on a quarterly basis, allowing us to monitor each companies’ performance and act when necessary to mitigate or encourage products, services and strategic decisions that relate to our impact objectives. Tracking these impact KPIs is intertwined with our financial and risk management KPIs – in many cases they are interchangeable – and we believe that incorporating all three aspects in our portfolio management leads to more resilient companies, sustainable social impact and high returns for investors.

We have provided a few examples of Sturgeon’s impact KPIs in support of employment, training and innovation below. Company KPIs are then aggregated to gauge our progress towards our targets at a portfolio level.

Exit

The success of Sturgeon’s investment framework is arguably most clearly shown upon exiting an investment. The insights, captured by our rigorous collection of data since inception, are also used to evaluate impact, financials, risk and ESG performance at exit against initial targets in order to measure the value generated by Sturgeon’s investment approach.

We believe that by incorporating impact into our investment framework we can foster more resilient businesses that deliver sustainable social impact and generate superior exit valuations that drive strong returns for our investors.

For a full breakdown of Sturgeon’s impact investment framework please contact the team:

Button

(1) Please contact Sturgeon for a detailed breakdown of how we calculate our financial return objective.

(2) Support’ is defined as both staff employed directly by investee companies, as well as jobs in directly supported/ financed enterprises. See appendix.

(3) For more details please refer to the Sustainable Development Report 2019 (includes SDG Index and Dashboards). Published by Bertelsmann Stiftung and Sustainable Development Solutions Network.

(4) For more details please refer to the IRIS+ website ( https://iris.thegiin.org/metrics/

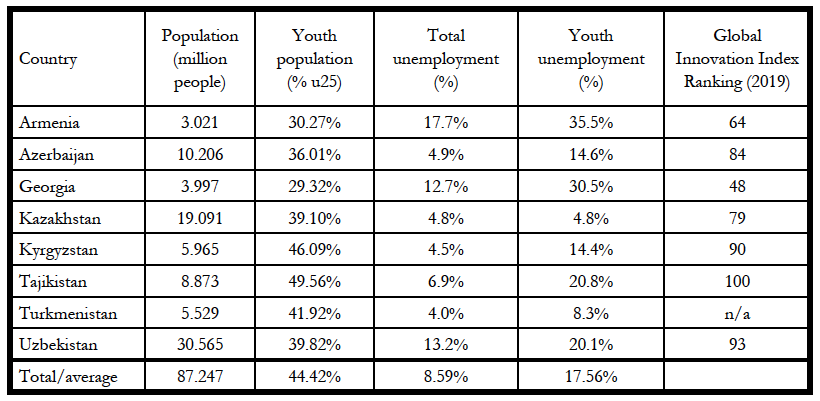

Sturgeon considers there to be two key factors which can drive social and economic development in frontier markets in Central Asia and the Caucasus:

- The creation of productive, private sector jobs, particularly for youth who make up 44% of the population and for whom employment opportunities are most limited.

- The necessity for product and service innovation to meet the needs of 87 million consumers in the region.

Youth unemployment is on average more than two times higher than the general level of unemployment in these countries. This poses a significant challenge for the governments in the region, but at the same time it is also an opportunity for targeted investments to create productive jobs and generate significant social and economic impact.

The region’s economies are still dominated by commodities or low value add industries, with little innovation.

Uzbekistan and Turkmenistan do not even feature on the 2019 Global Innovation Index Ranking of 129 countries. As a result, there are many inefficiencies across all sectors, which can be solved by technology-enabled companies to significantly improve the quality of life and opportunity for the region’s population.

Empowering people through employment can deliver long-term, sustainable and productive social impact. This is even more the case for the region’s youth on whom the future success of their economies depends. We have therefore set our impact objective at a portfolio level focused on creating employment opportunities in frontier markets through our fund investments, with an absolute goal of supporting 500,000 jobs in our first fund. Within this we target a 30% youth employment rate, with an emphasis on training and development.

Sources: CIA Factbook; World Bank/ILO; WIPO; GII

Disclaimer

This presentation is not an advertisement or a prospectus and is not intended for public use or distribution. It has been prepared by Sturgeon Capital Limited (“Sturgeon Capital”) for information and discussion purposes only with prospective eligible investors and should not be considered to be an offer or solicitation of an offer to buy or sell shares in the capital of the Fund. In particular, this document does not constitute an offer to sell, or the solicitation of an offer to acquire or subscribe for shares in the capital of the Company in any jurisdiction where to do so would be unlawful. This document, any presentation made in connection herewith and any accompanying materials do not purport to contain all information that may be required to evaluate the Company and/or its financial position and do not, and are not intended to, constitute either advice or a recommendation regarding shares of the Company. This document is not intended to provide, and should not be relied upon for, accounting, legal or tax advice and each prospective investor should consult its own legal, business, tax and other advisers in evaluating any potential investment opportunity.

The information in this presentation has not been fully verified and is subject to material revision and further amendment without notice. This presentation has not been approved by an authorised person in accordance with section 21 of the Financial Services and Markets Act 2000. As such this document is being made available only to and is directed only at: (a) persons outside the United Kingdom; (b) persons having professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (the “Order”); or (c) high net worth bodies corporate, unincorporated associations and partnerships and trustees of high value trusts as described in Article 49(2) (A) to (C) of the Order, and other persons to whom it may otherwise lawfully be communicated (all such persons together being referred to as “relevant persons”). Any failure to comply with these restrictions constitutes a violation of the laws of the United Kingdom.

The distribution of this presentation in, or to persons subject to the laws of, other jurisdictions may be restricted by law and persons into whose possession this document comes should inform themselves about, and observe, any such restrictions. Any failure to comply with these restrictions may constitute a violation of the laws of the relevant jurisdiction. This presentation may not be copied, circulated or published, in whole or in part, without the prior written consent of Sturgeon Capital.

None of the Company or Sturgeon Capital or any other person makes any guarantee, representation or warranty, express or implied, as to the accuracy, completeness or fairness of the information and opinions contained in this document, and none of the Company or Sturgeon Capital or any other person accepts any responsibility or liability whatsoever for any loss howsoever arising from any use of this document or its contents or otherwise arising in connection therewith.

In preparing this presentation, Sturgeon Capital has relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which Sturgeon Capital otherwise reviewed. The information presented in this document may be based upon the subjective views of Sturgeon Capital or upon third party sources subjectively selected by Sturgeon Capital. Sturgeon Capital believes that such third party sources are reliable, however no assurances can be made in this regard.

Neither this presentation nor its contents may be distributed, published or reproduced, in whole or in part, by you or any other person for any purpose. In particular, neither this presentation nor any copy of it may be: (i) taken or transmitted into the United States of America; (ii) distributed, directly or indirectly, in the United States of America or to any US person (within the meaning of regulations made under the US Securities Act 1933, as amended); (iii) subject to certain exceptions, taken or transmitted into Canada, Australia, New Zealand or the Republic of South Africa or to any resident thereof; or (iv) taken or transmitted into or distributed in Japan or to any resident thereof. Any failure to comply with these restrictions may constitute a violation of the securities laws or the laws of any such jurisdiction. The distribution of this document in other jurisdictions may be restricted by law and the persons into whose possession this document comes should inform themselves about, and observe, any such restrictions.

The value of investments and the income from them can fall as well as rise. An investor may not get the amount of money he/she invests.

This document may include statements that are, or may be deemed to be, forward-looking statements. The words “target”, “expect”, “anticipate”, “believe”, “intend”, “plan”, “estimate”, “aim”, “forecast”, “project”, “indicate”, “should”, “may”, “will” and similar expressions may identify forward-looking statements. Any statements in this document regarding the Company’s current intentions, beliefs or expectations concerning, among other things, the Company’s operating performance, financial condition, prospects, growth, strategies, general economic conditions and the industry in which the Company operates, are forward-looking statements and are based on numerous assumptions regarding the Company’s present and future business strategies and the environment in which the Company will operate in the future. Forward-looking statements involve inherent known and unknown risks, uncertainties and contingencies because they relate to events and depend on circumstances that may or may not occur in the future and that may cause the actual results, performance or achievements of the Company to differ significantly, positively or negatively, from those expressed or implied by such forward-looking statements. No representation or warranty, express or implied, is made regarding future performance or the achievement or reasonableness of any forward-looking statements. As a result, recipients of this document should not rely on forward-looking statements due to the inherent uncertainty. Save as required by applicable law or regulation, the Company undertakes no obligation to publicly release the results of any revisions to any forward-looking statements in this document that may occur due to any change in its expectations or to reflect events or circumstances after the date of this document. No statement in this document is intended to be, nor should be construed as, a profit forecast.

This document includes certain track record information regarding Sturgeon Capital. Such information is not necessarily comprehensive and potential investors should not consider such information to be indicative of the possible future performance of the Company or any investment opportunity to which this document relates. The past performance of Sturgeon Capital is not a reliable indicator of, and cannot be relied upon as a guide to, the future performance of Sturgeon Capital or the Company.

By accepting this document or by attending any presentation to which this document relates you will be taken to have represented, warranted and undertaken that: (i) you are a relevant person; (ii) you have read and agree to comply with the contents of this disclaimer; and (iii) you will treat and safeguard as strictly private and confidential all the information contained herein and take all reasonable steps to preserve such confidentiality.