It gives us great pleasure to present Sturgeon Capital’s 2022 Impact Report.

2022 Impact report

May 6, 2023

A lot has changed in our markets and our portfolio in the last 12 months. The world saw interest rates climb sharply as Central Banks around the globe scrambled to counter inflation, which was exacerbated by the Russian invasion of Ukraine and the subsequent rise in energy and food prices. Whether in developed or emerging markets, the impact of high inflation is most keenly felt by those at the bottom of the pyramid, with limited or no disposable income or savings to absorb the shock.

Whilst emerging markets have been historically accustomed to economic volatility and higher inflation and interest rates, the safety net left for those most economically disadvantaged in these societies remains inadequate and strained.

Therefore, investing in this environment requires focus on both financial returns and impact, with technology serving as an enabling mechanism to create long-term employment opportunities and to develop financial inclusion for those bearing the brunt of today’s troubles.

Although 2022 is behind us, the situation remains precarious. Notwithstanding macroeconomic headwinds, we believe the countries in which Sturgeon Capital invests will continue to benefit from a rapid digital transformation, so we are doubling down on our commitment to both a for-profit and a for-impact mission through our investments with the existing SEO I fund (Sturgeon Emerging Opportunities) and our new SEO II fund.

From an investment perspective, in 2022 we placed greater emphasis on Bangladesh, Egypt and Pakistan – three countries characterised by many of the same challenges and opportunities that we have seen in Central Asia. And whilst the under-30s make up the majority of the population in these countries, unemployment amongst them is disproportionately high. Creating jobs for this segment is one of the biggest challenges facing these economies: get it right, and they can be the engines for future economic and social development; get it wrong, and the risk of unrest and disruption increases. A theme prevalent across all our markets is the high number of unbanked or underbanked individuals,

limiting their ability to save for the future and raise their standard of living. Most consumers and businesses still operate offline, relying on manual processes to get things done. Although technology can solve these fundamental day-to-day problems in a more efficient and scalable way, local digital ecosystems remain nascent, with limited venture capital funding available. Sturgeon sees the same secular trend of rapid technological adoption across all our markets, presenting us with a unique opportunity to generate uncorrelated positive financial returns and contribute to widespread and meaningful impact in these economies.

| Bangladesh | Egypt | Georgia | Kazakhstan | Pakistan | Uzbekistan | |

|---|---|---|---|---|---|---|

| Population million (WB 2021) |

169m | 109m | 3.7m | 19m | 231m | 35m |

| GDP per capita (WB 2021) |

$2,457 | $3,698 | $5,023 | $10,373 | $1,505 | $1,983 |

| Median age (years) from cia.gov | 28 | 24 | 39 | 32 | 22 | 30 |

| Unemployment (WB 2022 – % of unemployed out of total labour force) |

5% | 7% | 11% | 5% | 6% | 6% |

| Youth unemployment (WB 2022 – % of unemployed in the labour force, ages 15-24) |

13% | 17% | 29% | 4% | 11% | 14% |

| Female employment % (WB 2022 – % of female population aged 15+ in the workforce) |

38% | 15% | 56% | 65% | 25% | 40% |

| Accounts at a financial institution (Findex 2021) |

38% | 26% | 70% | 81% | 16% | 44% |

| VC funding (2022) |

$112m | $517m | $7m | $59m | $347m | $7m |

| VC funding per capita | $0.66 | $4.73 | $1.89 | $3.10 | $1.5 | $0.20 |

In 2022, we made ten new investments, adding the following companies to our portfolio: GoZayaan in Bangladesh; NowPay and Brantu in Egypt; Abhi, Finja, Medznmore and Trukkr in Pakistan; Datacultr in the UAE; Finmap in Ukraine; and Oasis MFI in Uzbekistan. Of these ten investments, seven were in FinTech startups, tackling the largest addressable markets and greatest pain points in our regions. Abhi and NowPay are enabling employees to access their earned wages and salaries at any point in the month, reducing their reliance on extortionate informal lenders. Oasis MFI and Finja are addressing the borrowing needs of SMEs, which are the backbone of the economy and the generator of most employment opportunities. Similarly, Trukkr is banking the unbanked logistics sector in Pakistan with a SaaS-enabled lending solution. Datacultr is the digital debt collection platform that enables access to credit for first-time borrowers across global emerging markets. Finmap provides SMEs with simple and intuitive software that gives visibility of their cashflows for better planning and management. Together with the existing FinTechs in our portfolio, these startups disbursed 3.7 million loans to first-time borrowers in 2022. As inflation further squeezes real incomes in 2023, these solutions will be even more relevant.

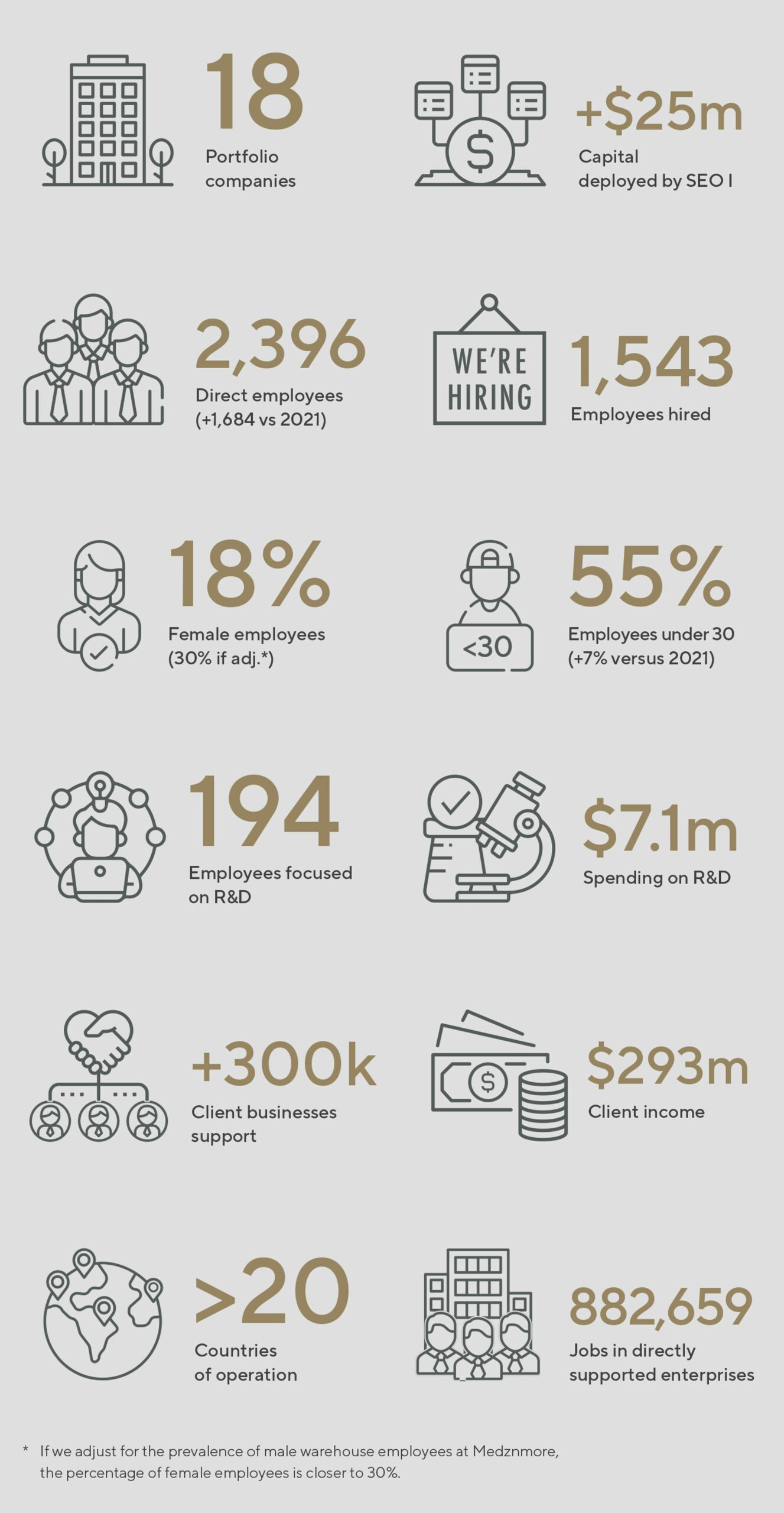

At a portfolio level, our 18 investees hired 1,543 employees and, at year-end, employed 2,396 people. Of this employee base, 18% were women, a decrease from 29% at year-end 2021. This number is distorted by companies – such as Medznmore – which have a large number of employees working in their warehouses, an environment which is almost entirely male. If we adjust for this, then the percentage of female employees is closer to 30%. Encouragingly, the percentage of employees under 30 has increased to 55%, demonstrating that technology companies provide employment opportunities for this demographic.

In total, our portfolio companies support over 300,000 businesses and 860,000 employees with their solutions, having invested $7m in R&D in 2022 to help solve the problems they face.

| Quarter ended Mar 22 |

Quarter ended Jun 22 |

Quarter ended Sep 22 |

Quarter ended Dec 22 |

Quarter ended Dec 21 |

|

|---|---|---|---|---|---|

| Total Portfolio Companies | 12 | 16 | 16 | 18 | 8 |

| Employment | |||||

| Total employees | 2,219 | 2,288 | 2,320 | 2,396 | 712 |

| Women as a % of total employee | 18.1% | 20.6% | 19.6% | 19.4% | 29.4% |

| Youth under 30 as a % of total employees | 58.5% | 58.0% | 61.5% | 54.8% | 47.8% |

| Employees hired | 595 | 373 | 304 | 271 | 132 |

| Employee wages paid | 6,082,160 | 6,538,099 | 6,575,766 | 5,381,497 | 3,995,720 |

| Involuntary turnover rate (%) | 2.4% | 6.6% | 4.9% | 2.8% | 0.8% |

| Voluntary turnover rate (%) | 7.3% | 9.8% | 5.5% | 8.2% | 13.3% |

| Jobs Directly Supported | |||||

| Jobs in directly spported/financed enterprises | 79,569 | 89,898 | 110,141 | 882,659 | 38,163 |

| Customer turnover | 44,557,855 | 61,826,567 | 80,067,168 | 106,628,372 | – |

| Innovation & Development | |||||

| Spending on R&D (US$) | 1,633,756 | 1,836,533 | 1,889,503 | 1,734,242 | 1,215,196 |

| Employees focused on R&D | 227 | 239 | 251 | 194 | 159 |

| Financial Inclusion | |||||

| Number of loans disbursed to first time borrowers | 1,056,924 | 1,192,107 | 730,936 | 807,802 | – |

Away from the portfolio, Sturgeon was particularly proud that Kamila Sharipova joined our team to conduct two in-depth research projects covering our markets: 1) Underrepresentation of Women in Venture; 2) Financial Inclusion and FinTech Models in Frontier and Emerging Markets.

Sturgeon is committed to building inclusive businesses whose products and services provide equal opportunities for all, and yet our understanding of the problem of women’s underrepresentation in our markets was limited in data and scope. The first report was designed to address that gap with a bottom-up analysis and is unique in its breadth and depth, based on more than 80 interviews with founders, investors and ecosystem players. It puts forward concrete proposals that Sturgeon Capital and the wider venture ecosystems can implement to encourage more women into the space, and we are grateful to Kamila for her diligence and work in preparing it.

The second report gives an overview of the state and speed ofdigitalisation in Sturgeon’s markets and highlights baseline penetration levels of digital payments, account ownership, credit and debit card coverage, as well as other financial indicators over the last decade to showcase the progression of each country in its journey toward a more sustainable, economically robust and financially inclusive future. We also look at comparable peers across Southeast Asia, Sub-Saharan Africa and LATAM to gauge parallels in development over the years, as well as to present examples of policy reforms that gave rise to the founding of some of the most successful FinTech companies across emerging markets. Finally, we present our view into specific FinTech models and infrastructural elements needed for further development, and showcase four companies from our portfolio that each provide unique financial solutions that are key in unlocking further financial inclusion and economic potential of these countries.

You can read both research studies in full on our reports section.

Download full report